salt lake county sales tax

Salt Lake County is located in Utah and contains around 11 cities towns and other locations. If you would like information on property.

Judy Weeks Rohner Utah Should Cut The Tax On Food Not The Income Tax

Average Sales Tax With Local.

. What is the sales tax rate in Salt Lake City Utah. The current total local sales tax rate in Salt Lake County UT is 7250. Notice of Value Tax Changes will be sent from the Auditors office by mid-July.

Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. Utah has state sales tax of 485. The certified tax rate is the base.

This is the total of state county and city sales tax rates. This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 7250.

The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. 2022 List of Utah Local Sales Tax Rates. Auditors office will start accepting property valuation appeals August 1 through September 15 2022.

You can print a 775. This rate includes any state county city and local sales taxes. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

Tax rates are also available online at Utah Sales Use Tax Rates or you can. The total sales tax rate in any given location can be broken down into state county city and special district rates. 2020 rates included for use while preparing your income tax deduction.

As for zip codes there are around 64 of them. Puerto Rico has a 105 sales tax and Salt Lake County collects an. The latest sales tax rate for North Salt Lake UT.

File electronically using Taxpayer. Bills and collects all real property taxes administers statutory tax relief programs refunds tax overpayments distributes all taxes collected to local tax entities. By law the annual tax process involves 5 steps.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. Welcome to the Salt Lake County Property Tax website. The latest sales tax rate for Salt Lake City UT.

To find out the amount of all taxes and fees for your. 2020 rates included for use while preparing your income tax. Salt Lake County Property Tax Process - Basics.

Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. 93 rows All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. This rate includes any state county city and local sales taxes.

Salt Lake County Assessors Office provides the public with the Fair Market Value of real and personal property through professionalism efficiency and courtesy. Tax Sale Excess Funds Outstanding Check Register Tax Codes ViewPrint my Tax Notices. The Utah state sales tax rate is currently 485.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Property taxes are levied at the state and local level based on assessed valuations established by elected county assessors and in the case of certain properties by the State Tax Commissions. The minimum combined 2022 sales tax rate for Salt Lake County Utah is 725.

A full list of these can be found below. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes.

Sales Taxes In The United States Wikipedia

Utah Family Courts Child Custody Info

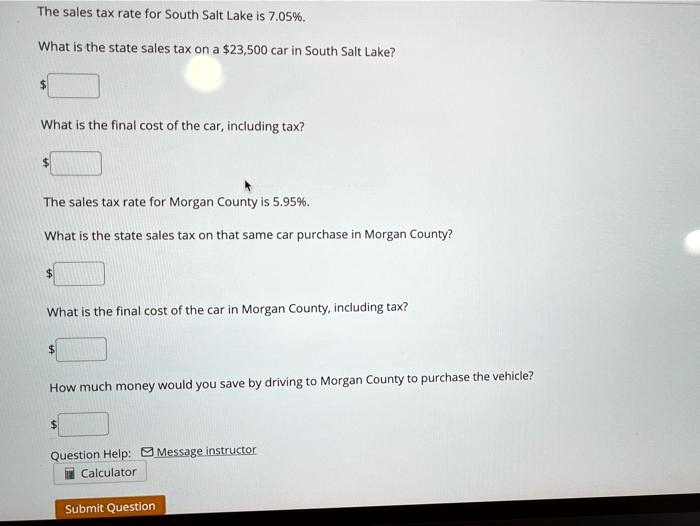

Solved The Sales Tax Rate For South Salt Lake Is 7 05 What Is The State Sales Tax On 523 500 Car In South Salt Lake What Is The Final Cost Of The Car

Utah Sales Tax Rates By City County 2022

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Salt Lake County Council Facebook

The Difference Between Origin And Destination Sales Tax

What S Living In Salt Lake City Like 2022 Ultimate Moving To Slc Guide

Amazon Com Salt Lake County Utah Zip Codes 48 X 36 Paper Wall Map Office Products

State And Local Sales Tax Rates 2019 Tax Foundation

Salt Lake City Utah Tourism Visit Salt Lake

What Is Sales Tax Rate In Salt Lake County

Salt Lake City Utah Sales Tax Rate 2022 Avalara

Lake County Tax Collector Serving Lake County Florida

Taxes Salt Lake City Utah County Treasurer S Office June 29 1892 Ebay